8 Ways to Manage Your Debt in Alberta

First off, let’s be honest—debt can be seriously stressful. But here’s the thing: there’s always debt help and a way forward. Managing debt isn’t just about numbers on a page; it’s about finding balance, easing your money stress, and getting control of your financial life again.

So, how can you get out of debt in Alberta? Take a look at these 8 options to manage your debt and start getting back on track.

1. Review Your Budget

Sometimes, giving your budget a fresh look can make a huge difference. Start by spotting areas where you can cut back to free up some cash for debt payments. Maybe that means taking the bus instead of driving, cooking at home rather than eating out, or cancelling non-essential subscriptions. Even small changes can add up over time. It might help to write down all your expenses, no matter how tiny, so you can see exactly where your money’s going. That way, it’s easier to spot where you can save on everyday expenses and say no to expenses not in line with your budget.

Also, think about boosting your income. Could you pick up a part-time job, start a side hustle, or sell stuff you don’t need anymore? Maybe you’ve got skills you can monetize, like tutoring, freelance writing, or offering handyman services. Every little bit helps when you’re trying to get ahead of debt, and even small increases in income can make a big impact. Remember, small tweaks in both cutting expenses and earning more can lead to big results over time. Each step forward is progress!

2. Refinance Your Loans or Mortgage

If those monthly payments are dragging you down, refinancing your loans or mortgage might help. Refinancing means extending the length of your loan, which can lower your monthly payments and make them more manageable. Keep in mind, you might end up paying more in interest over time, but if it helps you stay on top of payments now, it could be worth considering. Plus, you might snag a lower interest rate depending on the market and your credit score. A lower rate can save you a good chunk of money in the long run, even if your loan term gets extended.

It’s also a smart move to shop around and compare offers from different lenders. You’d be surprised how much rates and terms can vary, so doing a bit of homework could lead to better options. If you’re not sure where to start, maybe chat with a financial advisor who can guide you through the process.

3. Consolidate Your Debts

Debt consolidation lets you combine multiple debts into one single loan, ideally with a lower interest rate. With just one monthly payment to worry about, it can really simplify your finances and make debt repayment less stressful. Just be careful not to take on more debt after you consolidate, ’cause that could put you right back in a tough spot. Consolidation works best when you commit to avoiding credit cards or new loans until your current debt is paid off.

Plus, consolidating can sometimes boost your credit score over time as you reduce the number of accounts with outstanding balances. This can make a big difference if you’re planning any major financial moves in the future, like buying a home or car. Just make sure to review the terms carefully and ensure the new loan actually gives you a financial benefit—like lower payments, lower interest, or both. Learn more about the pros and cons of debt consolidation.

4. Borrow from Family or Friends (Carefully)

Talk about your financial situation with your family and friends. Borrowing from family or friends might be an option, and it can sometimes come with more flexible terms and little to no interest. But it’s important to approach this carefully. Clear communication is key—put everything in writing, including how and when you’ll repay them, to avoid any misunderstandings that could strain your relationship. Borrowing from loved ones can be emotionally tricky, so have an open and honest chat about expectations and what happens if you hit a snag in repaying.

One way to make this smoother is to treat it like a professional agreement. Set up a simple repayment schedule and stick to it. This shows you’re serious about paying them back and helps maintain trust. Also, consider if there are other ways they can support you without lending money directly, like helping with childcare or offering other non-financial assistance to reduce your expenses.

5. Talk to your Creditors

You might be surprised—creditors are often willing to work with you. If you’re struggling, consider giving them a call to discuss your options. You might be able to negotiate a lower interest rate or set up a different payment schedule that’s easier to handle. Just make sure to get any new agreement in writing so you’ve got a record of the new terms. Remember, creditors prefer to get paid over time rather than not at all.

When you reach out, it’s helpful to be prepared with a clear explanation of your financial situation and what you can realistically afford. Many creditors have hardship programs to help customers facing temporary financial difficulties. It might also help to mention if you’re considering other debt management options, like consolidation or a consumer proposal, as this might encourage creditors to work with you to avoid losing the debt entirely.

6. Check Out the Orderly Payment of Debts (OPD) Program

If you’re in Alberta, Money Mentors offers the Orderly Payment of Debts (OPD) program. OPD is an alternative to bankruptcy for some Albertans. This program helps you pay off unsecured debts at a reduced interest rate of 5%, providing a structured path out of debt while protecting you from collection actions like wage garnishments. If you’re feeling overwhelmed, the OPD program might be a great fit—there’s a self-assessment on their website to see if it’s right for you.

One big benefit of the OPD program is that it helps you regain control with a clear plan and structured payments. The reduced interest rate can significantly cut down the total interest you pay, letting you pay off your debt faster. Plus, the program includes financial education resources to help you build better money habits for the future, so you can stay debt-free once you’re done. Find out if the OPD program is a good option for you.

7. Consider a Consumer Proposal

A consumer proposal is a formal agreement with your creditors to repay a portion of your debt over time. It’s a legally binding process that lets you keep your assets while getting relief from overwhelming debts. This is a good option if you can make partial payments but can’t repay the full amount owed. A consumer proposal can also stop collection calls and legal actions from creditors, giving you some much-needed breathing room.

It’s important to know that a consumer proposal will affect your credit score, but it’s usually less severe than bankruptcy. You’ll work with a Licensed Insolvency Trustee (LIT) to create a proposal that your creditors are likely to accept. If they approve it, you’ll make regular payments to the LIT, who then distributes the funds to your creditors. Consumer proposals can offer peace of mind by giving you a clear path forward, even if it takes several years to pay off the agreed portion of your debt. Learn more about the pros and cons of a consumer proposal.

8. Bankruptcy as a Last Resort

If it is not too late, it is best to avoid bankruptcy. But bankruptcy can offer a fresh start if you’ve got no other options. It clears most unsecured debts and can relieve the constant stress of overwhelming financial obligations. However, it does come with serious consequences for your credit rating and financial future, so it’s crucial to fully understand the process and explore all other options first.

Declaring bankruptcy can be emotionally tough, but it might be the lifeline you need if you’re buried in debt with no feasible way to repay it. You might have to give up some of your assets, and there will be restrictions on your financial activities until you’re discharged. But bankruptcy can give you the chance to start over and rebuild your financial life from scratch. Be sure to speak with a Licensed Insolvency Trustee to understand what filing for bankruptcy would mean for your specific situation.

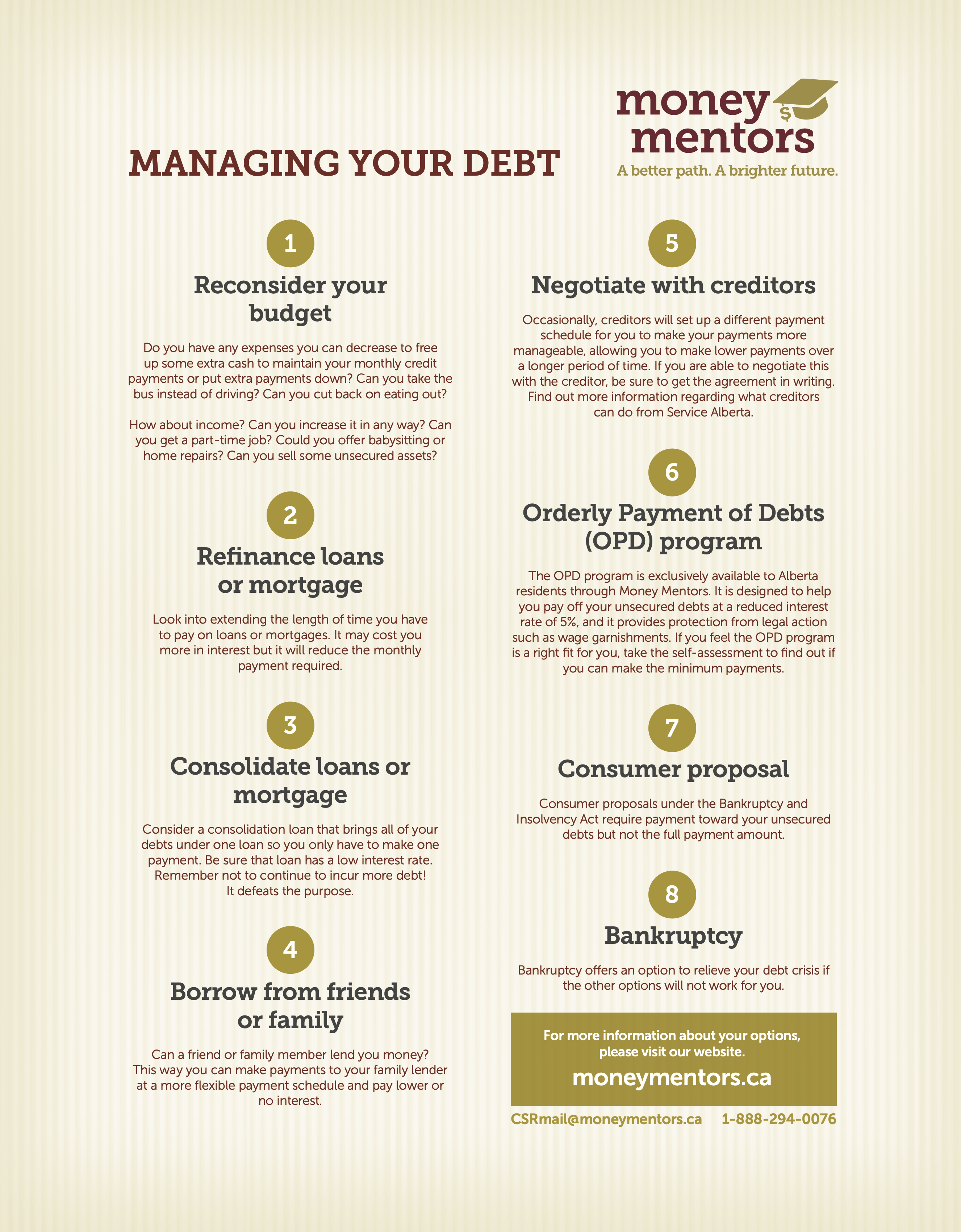

Download the Managing Your Debt Infographic

To download the PDF, click here.

Moving Forward

Debt can feel like a heavy burden, but remember, you are not your money. There are plenty of ways to regain control, whether it’s paying off one debt at a time or more structured support. It’s about finding the right solution to get out of debt and taking it one step at a time. If you’re noticing signs of debt and feeling stuck, Money Mentors is here to help. We’ve helped hundreds of Albertans just like you become debt-free. We offer a wide range of resources such as this debt repayment calculator and personalized support to help you tackle debt in a way that works for you. Don’t hesitate to reach out—whether it’s for credit counselling, some advice, or just to learn more about your options, they’re here to provide compassionate guidance and help you find your way to financial well-being.

Have questions?

Need more information or want to talk to an accredited financial counsellor for peace of mind? Let us help.

Call 1-888-294-0076 or book an appointment. It’s free for all Albertans.