Credit Ratings & Credit Scores

We all know a good credit score can help us get further in life―for example, when purchasing your first house or buying a new car. But how many of us actually know our credit score?

Not as many as you’d think!

In fact, 25% of Canadians surveyed in 2018 had never checked their credit score before (Equifax Canada). Are you one of them?

There is lots of misleading information out there about credit scores and credit ratings, so we’re going to clear things up for you. From understanding the difference between a credit rating and a credit score to debunking common myths our counsellors hear, we want you to walk away feeling confident and credit savvy.

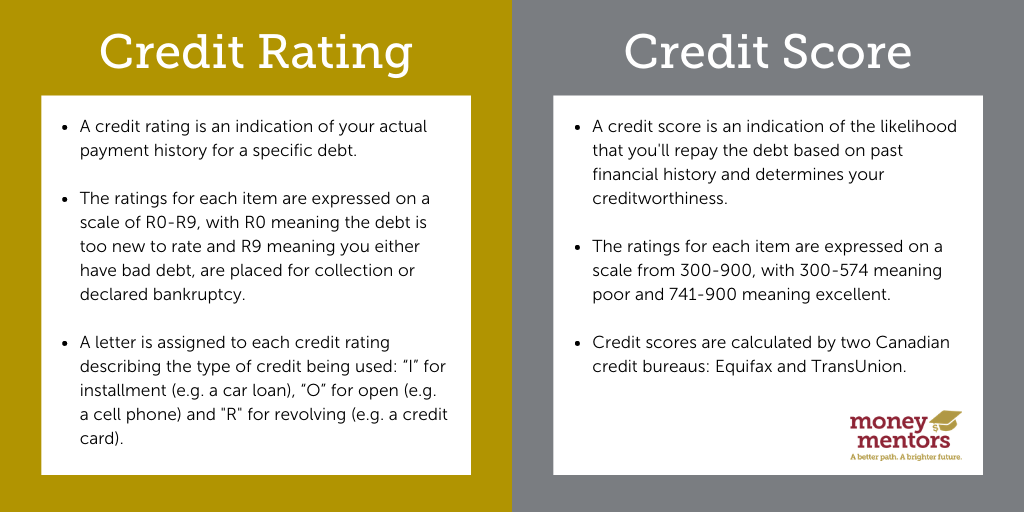

Credit rating vs. credit score

Determined by independent third parties, credit ratings and credit scores help potential lenders and creditors understand your financial history and ability to repay debt. Credit card companies, car dealerships, mortgage lenders and even phone providers will look at your credit history to help them decide whether they want to do business with you.

But there are some key differences between the two:

Credit ratings reflect nothing more than the payment history for each individual debt. Credit ratings are expressed on a scale from RO (meaning the debt is too new to rate) to R9 (meaning you either have bad debt, are placed for collection or declared bankruptcy). A letter is assigned to each credit rating describing the type of credit being used: “I” for installment (e.g. a car loan), “O” for open (e.g. a cell phone) and “R” for revolving (e.g. a credit card).

A credit score is the number between 300-900 that provides an overall view of an individual’s likelihood of repaying a loan based on past financial history and determines your creditworthiness. Credit scores are calculated by two Canadian credit bureaus: Equifax and TransUnion. The credit rating is one factor of about five that goes into determining the credit score. Refer to our free online course, Credit Cross-Training, for further information.

Common credit myths

Myth #1: You can only check your credit score for free once a year.

You can actually pull your credit report from each credit bureau (Equifax and TransUnion) once per year for free by mail or phone. This only gives you access to the debts that are listed on your report and their ratings. Getting your credit score requires paying an additional fee. Services such as Credit Karma and Borrowell provide free access to your credit score, drawing on information from the credit bureaus, and provide a good ballpark idea of what your score is. However, it should be noted that these third-party services don’t always provide the full picture and can sometimes worry Albertans for no reason. The most reliable way to know your score is by ordering it from the credit bureaus directly.

Myth #2: Debt management programs (OPD, bankruptcy and consumer proposal) permanently ruins your credit score.

Legislated debt management programs limit access to credit for several years, but they do not permanently ruin someone’s credit score. You can always rebuild your score! In an Orderly Payment of Debts (OPD) program and consumer proposal, the program is on the credit report during the repayment period (usually five years or less). During this time, it will not be possible to get credit. OPD remains on the credit report for two years after the debts are paid off, while a consumer proposal remains on the report for three years after paying off the debts. It is possible to get credit after the debt is paid off, even if the program is still reporting on the credit report, but creditors may place additional conditions on it, such as higher down payments, higher interest rates and/or the debt being joint or co-signed. In a first bankruptcy, the debtor is under court ordered bankruptcy protection for 9 or 21 months, depending on the debtor’s income. It won’t be possible to get credit during that time. After the conditions of the bankruptcy have been met, the debts are “discharged,” and the bankruptcy is on the credit report for six or seven years depending on which province you live in. It will be very difficult getting credit for at least two years after a bankruptcy is discharged. A secured credit card is a common way to start rebuilding credit. Having said that, it’s not unheard of for clients to get lines of credit, car loans and even mortgages while any of the above programs are still on the credit report AFTER all the debt has been paid, though additional conditions will likely be applied. Once the above programs come off your credit report, you have a fresh start and can continue to rebuild your credit score moving forward.

Myth #3: Checking your credit score will negatively affect it.

This one’s tricky! According to Equifax, “While pulling your own credit report does result in a ‘soft’ inquiry on your credit reports, it will not affect your credit scores. In fact, knowing what information is in your credit reports and checking them regularly may help you get in the habit of monitoring your financial accounts.” On the other hand, “hard inquiries” do affect a credit score. The Equifax website says, “When a lender or company makes a request to review your credit reports as part of the loan application process, that request is recorded on your credit reports as a hard inquiry, and it usually will impact your credit scores.” The reason for this is that the credit bureaus regard multiple credit inquiries in a short period of time as increasing the likelihood that a borrower is carrying a lot of debt. Borrowers who carry a lot of debt are seen as “risky” in terms of their ability to repay the debt. Credit bureaus identify those potentially risky borrowers by lowering their credit score. Having said that, most people can have their credit report pulled three or four times per year without negatively affecting their credit score. An exception to the above practice is when you are shopping around for a major purchase like a car or mortgage. Again, according to Equifax, “multiple inquires for the same purpose within a certain period of time (usually 14-45 days) are generally counted as one inquiry.”

Myth #4: Closing a credit card account will affect your credit score.

This is possible in a couple ways. First, closing a credit card affects “credit utilization.” Credit utilization is the percent of total available credit that you’re currently using. When you close a credit card, the available credit drops, which means your percent of available credit used increases. Higher credit utilization levels can negatively affect your credit score. To limit this impact, either close lower limit cards and keep higher limit cards or request an increased limit on the remaining cards to offset the reduced credit that’s available when a card is closed. Second, if you close a card that you’ve had for awhile, it could negatively affect credit history over time. The reason for this is that the closed card would stay on your credit report for several years after closing it. Eventually it drops off, leaving cards that you haven’t had as long. At that point, your credit history would appear shorter than is actually the case. People with shorter credit histories are generally considered higher risk borrowers, which could cause the credit score to fall a little. To limit this impact, try to keep your oldest cards open while closing newer cards instead.

Myth #5: Spouses share credit reports. Anything one person does affects the rating/score of the spouse.

A spouse’s debt, whether acquired before or during the marriage, does not affect the other spouse’s credit unless the debt is joint, co-signed or one spouse is made an authorized user of the other spouse’s credit card or line of credit. While solely owned debt doesn’t directly impact a spouse, the poor credit of one spouse can indirectly affect the other spouse by impacting their ability to get joint debt like mortgages or car loans.

Myth #6: Each person only has one credit score.

There are two credit bureaus in Canada: Equifax and TransUnion. Some creditors report to one bureau and not the other, so each bureau may have different information on any one individual. Each bureau also uses their own calculations and algorithms to calculate a credit score. As a result, the same individual may have a different credit score at each credit bureau.

Myth #7: Paying my utilities bills on time will improve my credit.

Unfortunately, this isn’t the case. Utilities and most cable/Internet providers (Enmax, Epcor, Direct Energy, Shaw, Telus, etc.) do not report payment histories to the credit bureaus unless payments are in default. If payments are up to date, they will not influence your credit score. If payments get behind or go to collections, they can be reported and will have a negative affect on the credit score. One exception to this appears to be Rogers Cable, which some have said are reporting to the bureaus regularly. Cell phone companies also report payment histories to the credit bureaus, so keeping your cell phone payments current can help to improve your credit score.

Educate yourself

There’s always more to learn when it comes to credit ratings and credit scores. We offer a free online course, Credit Cross-Training, to help Albertans learn how to organize their current finances, plan for their application, understand credit reports, build credibility, research the best credit options for their unique situation, understand what creditors look for, and be a wise credit user.

We also offer another free online course, Credit & Lending 101, which is designed to help Albertans understand what factors are taken into account when reviewing a credit application.

Lastly, learn how to rebuild your credit step-by-step and get your financial affairs in order with our free Credit Comeback workbook.

Talk to a professional

Have any other questions or concerns about your credit? Our accredited, experienced counsellors are only a phone call or email away! They’ll walk you through your current finances, answer any questions you may have and help you figure out a Money Action Plan. Book an appointment today!

Have questions?

Need more information or want to talk to an accredited financial counsellor for peace of mind? Let us help.

Call 1-888-294-0076 or book an appointment. It’s free for all Albertans.