Reminder: You Are Not Your Money

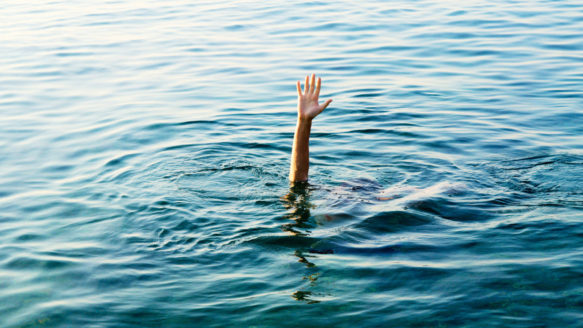

When you’re drowning in collection calls, unpaid bills and multiple jobs, it can be difficult to separate yourself from your debt. And the opposite is true, too―when you’re feeling confident with your finances, paying your bills on time and have plenty of savings, you might have a hard time separating your self-worth from your money.

But your net worth does not equal your self-worth.

Your self-worth is not tied to how much (or how little) is in your bank account, what possessions you have, or what sort of lifestyle you can afford.

Your self-worth is not tied to your salary, your education, or your means in life.

Your self-worth is not tied to how much debt you hold, how much help you need, or how far away you are from your financial goals.

Your self-worth is tied to your values, personality, and qualities.

While understanding your net worth is important in the overall picture of your finances, it bears no weight to who you are as a person.

Mental health and financial health

As you know, there is a direct correlation between your mental health and your financial health. Whether it’s financial stress that’s keeping you up at night, living with financial regret or trying to keep up with family or friends―all of that can weigh heavily on your mental and financial health, leading to burnout. But that’s not all. The way you view your worth can affect other areas of your life, too.

You may:

- Feel depressed or anxious

- Feel disengaged at work, therefore performing poorly

- Feel disengaged at home, therefore missing out on important family moments

- Rely on retail therapy to make yourself feel better, pushing yourself deeper into debt

- Strain your relationship with your partner

- Turn a blind eye to your problems altogether, furthering your debt cycle

The problem with tying your self-worth to your net worth

There are many problems with connecting your self-worth to your net worth, but one of the biggest ones is that money is variable. You are not in the same financial position you were in last year, nor will you be in the same position next year. You could lose your job or get a promotion. You could unexpectedly need to dip into your emergency savings. You could take on more debt or pay off your debt. Your family could grow or you could move. Money is forever changing, and therefore it is impossible to tie it to any part of your self-worth. Who you are as a person is the one constant in the sea of fluctuating finances. Don’t allow yourself to be dragged down by those fluctuating tides.

How to separate your money from your self-esteem

In order to see yourself in a new light, you need to step out of your money’s shadows. By removing yourself from your financial equation, you can view your self-worth as a separate entity. Here are five ways you can do this:

- Redefine your values

The first step in separating your self-worth from your net-worth is to redefine what you value. Make a list of everything that is important to you and figure out where money falls on that list. Do you value family time over money? Do you value travelling over material possessions? Whatever makes it on the list―and in whatever order―start viewing your life with this new lens.

- Reassess your environment

Next, take inventory of your life as a whole. How are you affected by those in your life, your job, your community? Do you feel a constant pressure to keep up with those around you or feel a need to perform at a higher level? Are you endlessly exhausted with where you’re at in life? You may be due for a change. If you aren’t feeling supported, elevated or accepted by your family, friends, co-workers or neighbours, perhaps you need to bravely seek out a new perspective. If possible, find a new job, meet new people (and ditch those dragging you down), move somewhere else, and savour new experiences.

- Embrace yourself

The way you talk to and care for yourself matters. If you routinely tell yourself you’re not good enough until you master X, then you’re setting yourself up for failure. Rework your negative self-talk into something more positive like:

“I am more than my money.”

“I know my worth.”

“I am worthy of happiness.”

“My struggles are opportunities to learn and grow.”

“I am worth investing in myself.”

“I have a healthy relationship with myself and my money.” - Learn more about personal finance

If you’re struggling to manage your money and feeling lost just thinking about it, you might need to learn more about it! Luckily, there are lots of free resources out there for you to boost your financial literacy―and all from the comfort of your home. Money Mentors offers a variety of free online courses for Albertans to complete that cover topics like retirement planning, budgeting, tackling debt, spending less, fraud prevention, and raising a family. We also have free financial calculators to try, as well as lots of free spending plans and workbooks to download.

- Ask for help

Lastly, don’t do this alone. There are so many professionals ready to help you―from mental health specialists to credit counsellors like Money Mentors. Our counsellors are accredited, unbiased and have years of experience helping Albertans just like you. Whether you require debt relief through the Orderly Payment of Debts program, credit counselling or money coaching, we are a phone call away from changing your outlook on life. Book a free appointment today!

Remember, changing the way you view yourself, your money and your life will not be easy. It’s a long and strenuous journey but it is possible. Your mental, emotional, physical and financial health will thank you for it! We believe in you!