10 Financial New Year’s Resolutions You Need to Make in 2025

As 2024 draws to a close, many of us are reflecting on the year gone by and looking ahead with optimism. It’s been a year filled with its own unique challenges and opportunities, a reminder of the ever-changing economic landscape we navigate.

As we embrace the new year, it’s a perfect time to reevaluate our financial strategies. Whether the economic climate has been turbulent or stable, the turn of the year offers a fresh start to reassess our financial goals and habits. Financial New Year’s resolutions are more than just a tradition; they’re a proactive step towards financial empowerment.

In this spirit, let’s set meaningful and attainable financial resolutions for the upcoming year. From redefining savings goals to exploring new investment opportunities, each resolution is a building block towards a more secure and prosperous financial future. Embrace this chance to transform your approach to personal finance and set the stage for a year of growth and success.

Here are 10 easy financial resolutions that you can make (and achieve!):

- Look at Last Year’s Financial Mistakes and Victories

- List Your Financial Goals

- Start a Budget

- Change Your Spending Habits

- Automate Your Online Banking

- Pay Fast, Buy Slow

- Pay Off Your Credit Card Balance in Full

- Talk Finances with Others

- Take a Financial Literacy Course

- Consolidate Your Debt

- Look after your mental health

- Participate in our monthly financial challenges

- Start a side hustle

- Learn together at work

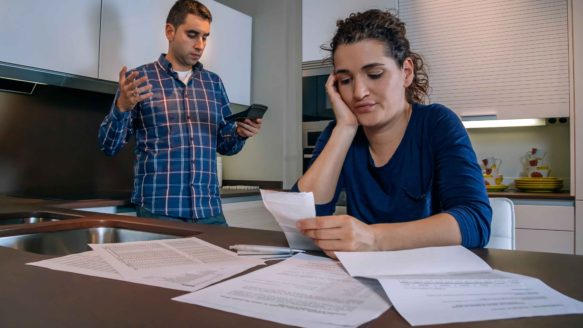

You can’t plan for the future if you don’t look at your past. Go through your bank and credit card statements and see where you’re currently sitting. What financial mistakes did you make last year? What did you succeed in?

Once you’ve taken a look at your past financial mistakes and victories, make a list of your financial goals for this New Year. They can be overarching, big goals or smaller, specific goals. Whatever you wish to achieve, jot them down somewhere you can see them every day.

Now that you know what financial goals you want to achieve this year, create a budget to make them happen. How much money do you bring in each month and how much of that goes to household expenses, childcare, commuting, entertainment, clothes, paying off debt, etc.? Take a good, hard look at your money and then make an action plan to stay ahead of the game.

Let us help

Not only do we offer a free downloadable spending sheet, but if you’d like to book a free counselling session, one of our credit counsellors will help you go through the spending sheet and fill it out. Give us a call.

Once you know how much of your money will be going to each category, think about how you spend your money on any given day. Do you buy coffee each morning? Go out for lunch once a week? Pay for services you never use? Assess your spending habits and then commit to changing at least one of these habits to save you money.

Technology has given us the power to save money more easily and efficiently. By automating your online banking to withdraw money from your chequing account to go into your savings, TFSA or RRSP accounts, you’ll never have the excuse of forgetting or not planning for it. This is also a great way to start an emergency fund.

To make sure you stay on track with your finances, live with this simple rule: pay fast and buy slow. Pay your bills as soon as they come in to avoid late fees and help you understand exactly how much money you have leftover. And adopt a slower spending approach to help minimize impulse purchases and increase rational thinking. This can be done by implementing a “pause” period between when you first consider purchasing something and when you actually purchase it.

If you can’t pay off your balance in full, at least aim to pay off more than the minimum payment. Ensure you have the money in your bank account before making purchases on your credit card. This will help you break the never-ending cycle of working to pay off your credit card while you add more purchases onto it.

Try our calculator!

We have a calculator that can help you. It’s called ‘Roll Down Your Debts’ and our clients find it very helpful. Enter your credit card balances, interest rate and minimum payment. Try for free by clicking here.

To make sure you stay on track this year, get the support of your family and friends. Tell them your financial goals and how they can help you achieve them―whether that’s going out for dinner less and adopting a cheaper hang out routine, or simply being a “check-in” person for you to update them on your progress.

Expanding your financial literacy is one of the best investments you can make for yourself this year. Learning more about money management, debt, credit, budgeting, retirement, etc. will not only help you now but for years to come. A great way to start is by picking up a personal finance book from your local library or educating yourself through our useful financial education classes.

If you haven’t already, make an appointment with one of our experienced and compassionate credit counsellors to look at your debt consolidation options. Carrying multiple balances (and all with varying interest rates) can be intimidating and all-consuming. Make it your mission this year to end the constant stress of debt by seeing if you qualify for our Orderly Payment of Debts (OPD) program.

Bonus Financial Tips

January is widely regarded as one of the most depressing months, so it’s more important than ever to make sure you have a plan for your mental health! Try this article for some important tips on how to stop stressing about money.

Every month on our social channels and e-newsletter, we challenge our followers to make a change in their financial routine. It’s a great way to break old habits, learn something new about yourself and get one step closer to financial freedom. Join us now on Facebook, Twitter and Instagram!

If you’re having trouble making your minimum payments on your credit card or are spending more than you’re bringing in, maybe it’s time to start a side hustle to make more money. There are lots of ways to do this—from babysitting, dog-walking, pet sitting, house sitting, baking, crafting, coaching, refereeing, tutoring, landscaping, etc. The options are endless and can make you good money on the side!

Money Mentors offers workplace financial education workshops for companies and communities to partake in, with topics ranging from tackling debt, planning for retirement, fraud prevention and everything in between. We’d be more than happy to come talk to your employees/co-workers about personal finance!

Happy New Year, everyone! Let’s make the most of these next 12 months and invest in ourselves!