6 Tips to Help You Start a Money Diary

Welcome to Part 2 of our Money Diary series! Last month we chatted about the importance of money diaries and why you should start one―from learning how to budget to celebrating your daily wins.

This month, we’re delving deeper to help you learn the tips and tricks to make your money diary a success.

Here are 6 easy ways to use your money diary or spending journal:

- Jot it down

There are lots of ways to do it―like in an old-fashioned pen-to-paper notebook, downloadable worksheet, cell phone app or spreadsheet. Whichever way you choose, make sure it’s handy and easy to use. The less steps you have to take to make a diary entry, the more often you’ll do it!

- Schedule it

Set aside some time every evening to go through that day’s finances. Even if it’s just five or 10 minutes! By making it part of your nighttime routine―like brushing your teeth or having a glass of wine―you’ll be less likely to forget and will eventually become a healthy habit.

- Visualize your financial goals

We’ve all heard that inspiration or vision boards can help make your dreams come true. The more you see something in front of you, the higher the chance it’ll happen. The same goes with your financial goals! Each week list a financial goal you’d like to set―whether that’s an over-arching, big goal or something smaller and easier to accomplish that week. Whatever it is, write it down or draw it in your journal. And then go back to that page every day to reflect on how that goal is going and if there are any changes you need to make to your daily finances.

- Budget for your week

Sundays are a great day to figure out that week’s budget. From groceries, gas, bills, etc., narrow down where your money will be going and how much extra you have left over. If you need advice on how to set up a budget, refer to our free Stretch Your Dollars budgeting workbook or Spending Plan. This is also a great time to plan for the week ahead. Do you have a date night scheduled or seeing friends? Make sure to allow for these outings and other plans you may have so you don’t run out of money.

- Track your spending

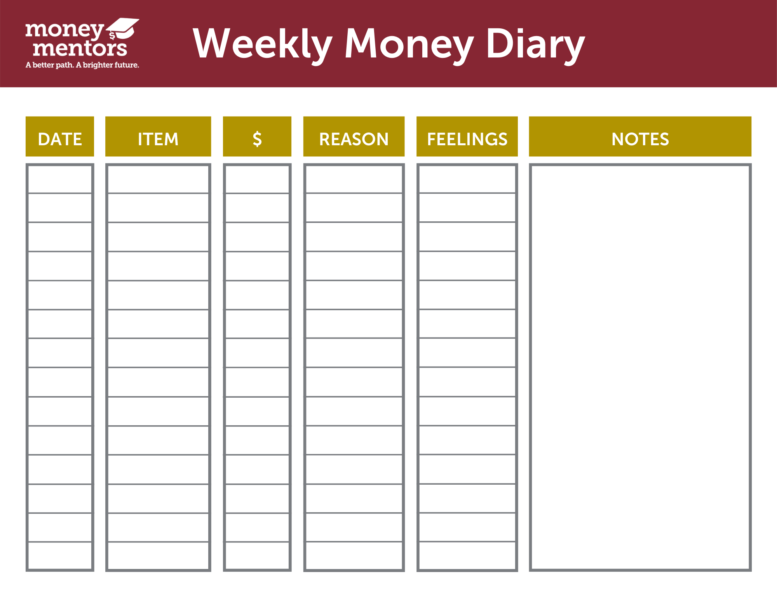

At the end of every day, go through your daily receipts and bank accounts, and then list each dollar you spent. It’s important to track each expense thoroughly―like what you spent your money on, if it was a want or a need, how much it cost you, how you paid for it, why you bought it, and perhaps how it made you feel. While it might seem like a lot of information now, it’ll help you at the end of the month understand your spending habits better.

- Feel inspired

Whether it’s an idea for a new way to make more money, money mantra or a fun little doodle, your money diary is the place to get creative and find inspiration. Money doesn’t have to be boring! Just follow your gut and do what feels good.

Remember, don’t feel discouraged if you overspend one week or are nowhere close to reaching your financial goals―it happens to the best of us! Just take one day, one week at a time and keep aiming to do better. We promise that after a month of money diary entries, you’ll feel more confident in your financial decisions and dreams.

Download our Money Diary PDF template now!

What’s next?

Okay, so you’ve managed to keep a money diary for a month or more, but where do you go from here? If you’re still unsure about what your next steps should be, talk to a professional! Our accredited, experienced counsellors are here to provide free money coaching and credit counselling to Albertans, so you can finally reach those financial goals that may seem out of reach.