Debt Management Programs vs. Orderly Payment of Debts (OPD): What’s the Difference?

Choosing the right debt help program is really, really important for your future.

Being in debt is like trying to swim with ankle weights — without the right help, it’s hard to stay afloat. But the good news is that there are solutions designed to help. Two common options are the Debt Management Program (DMP) and the Orderly Payment of Debts (OPD) program. While both help pay off debt, they work in different ways.

This article will explain how each plan works, their pros and cons, and help you decide which one fits your situation best. Whether you need a debt relief program in Alberta, a way to consolidate multiple payments, or guidance on managing debt effectively, understanding your options is key.

What is a Debt Management Program (DMP)?

A Debt Management Program (DMP) is a voluntary program offered by credit counselling agencies to help people combine their debts into one easier payment.

How a DMP Works:

- You work with a credit counselling agency that talks to your creditors to lower interest rates or remove fees.

- Your debts are combined into one monthly payment.

- The agency sends your payment to your creditors.

Pros of a DMP:

- Lower interest rates: Many creditors agree to charge less interest, so you pay off your debt faster.

- One simple payment: Makes it easier to keep track.

- Avoids bankruptcy: Helps you pay off debt without the severe consequences of bankruptcy.

- Fewer calls from creditors: Once enrolled, collection calls usually slow down or stop.

Cons of a DMP:

- Not legally binding: Creditors do not have to agree and can leave the plan anytime.

- Interest rates are different: Some creditors will cut interest, and other creditors may not lower interest much, if at all.

- Doesn’t cover all debt: Government and tax debts are not included.

- Credit score impact: The fact that you are in a DMP is noted on your credit report and can lower your score for a while.

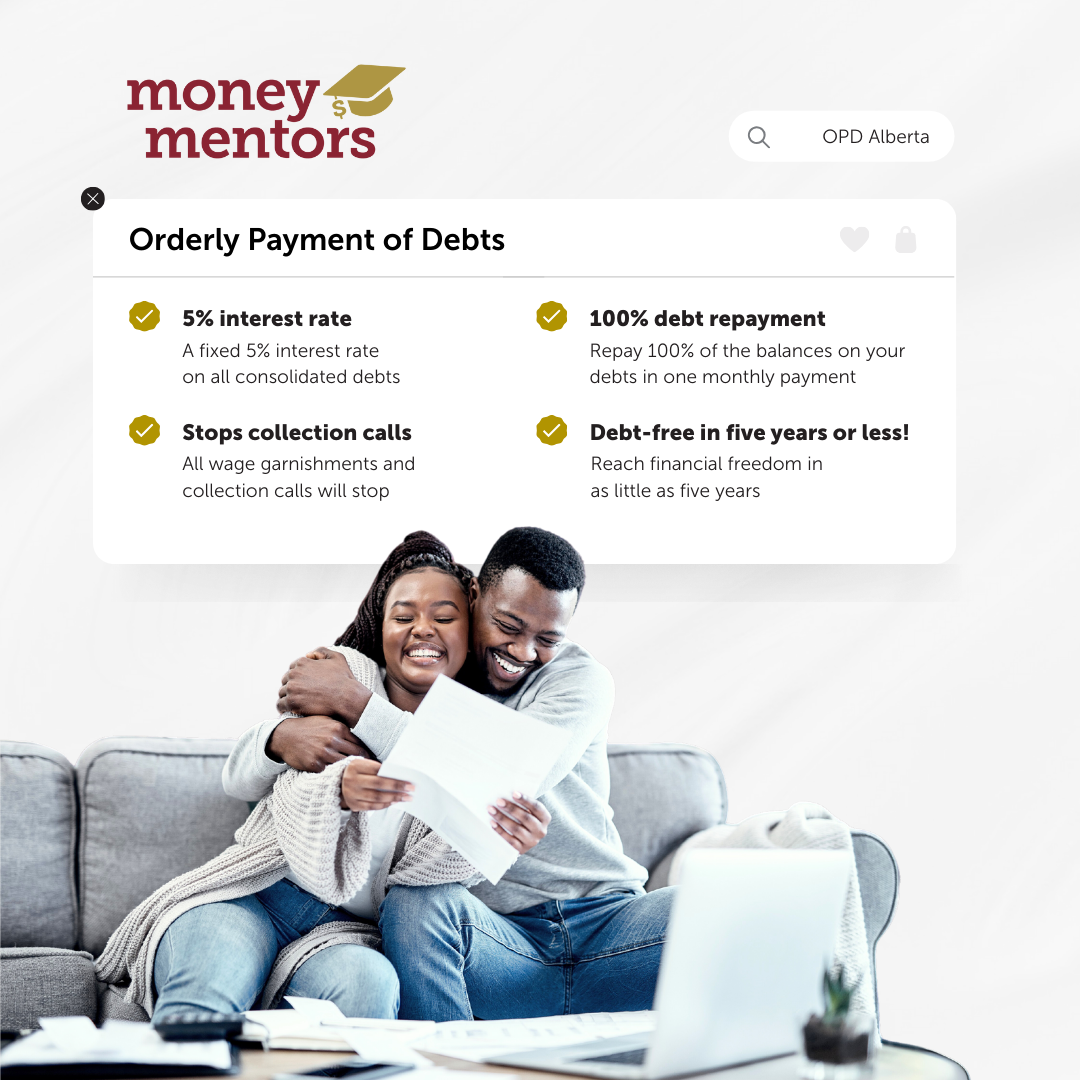

What is the Orderly Payment of Debts (OPD) Program?

The Orderly Payment of Debts (OPD) program is a government-approved way to repay debt in Alberta. In Alberta, Money Mentors is the exclusive and only place that runs the OPD program.

How OPD works:

- All of your debts (unsecured, government, and/or student loans) are combined into one affordable monthly payment.

- No matter how high your interest rates are — 35%, 26%, or any other number — it will be lowered to a fixed 5% for all debts in the program.

- The program is legally binding, so all creditors must participate.

- You are protected from lawsuits and wage garnishments while in the program.

Pros of OPD:

- Set 5% interest rate: Much, much lower than the average credit card or payday loan rates.

- Government-approved: Creditors can’t refuse to be part of the program.

- Stops wage garnishment and legal action: Unlike a DMP, OPD prevents lawsuits and collection efforts.

- Covers government debts: Includes CRA tax debt, which DMPs do not.

- Budgeting help: Money Mentors teaches you how to manage your money better.

Cons of OPD:

- Only available in Alberta.

- Credit score impact: Like a DMP, OPD affects your credit report for up to two years after finishing. But if you make payments on time, you can get a letter to show any new lenders. We also offer free seminars on rebuilding your credit.

Key Differences Between DMPs and OPD

| Debt Management Program (DMP) | Orderly Payment of Debts (OPD) | |

|---|---|---|

| Do creditors have to follow the program? | No, it’s voluntary — creditors can choose whether to accept the plan, and they can withdraw at any time. | Yes, it’s mandatory — the court makes it official, and all creditors included in the program must follow its rules. They cannot opt out. |

| How much interest will I pay? | It depends — creditors may lower rates, but it’s different for everyone. | 5% — you only pay 5% interest, no matter what your rate was before. |

| Where is this plan available? | Canada-wide. | Alberta only. |

| What debts are covered? | Unsecured debts (but not CRA debt or taxes owing) | Credit cards, payday loans, overdrafts, government & CRA tax, student loans, and more. |

| Does the program legally stop collections and wage garnishments? | No. Creditors may stop collections and lower interest, but they aren’t required to and can still take legal action. | Yes. Creditors are legally required to stop calling for payments and taking money from your paycheques. |

Why Choose OPD with Money Mentors?

Money Mentors is the only OPD provider in Alberta, giving Albertans a trusted way to repay their debts. Here’s why Albertans choose Money Mentors:

- 100% transparent and non-profit: Money Mentors is here to help, not make a profit.

- Personalized financial counselling: Accredited Financial Counsellors provide one-on-one support.

- Educational resources: Budgeting workshops and online financial literacy courses to help prevent future debt.

- Proven success stories: Thousands of Albertans have successfully used OPD to get back on track.

👉 Read: Is OPD Right for You?

How to Decide Which Option is Right for You

When choosing between a DMP and OPD, think about:

- How much debt you have: OPD is better for higher debt amounts and tax/government debts.

- Who you owe money to: If you have tax or government debt, OPD is the better choice.

- Do you need legal protection?: If creditors are taking legal action, OPD gives stronger protection.

- Interest rate needs: OPD’s 5% rate is often lower than the rates negotiated in most DMPs.

- Will all creditors agree? OPD forces all creditors to join, while DMPs depend on voluntary agreements.

Still unsure? Book a free consultation with Money Mentors and get expert advice.

👉 Learn more: Alternatives to Bankruptcy in Alberta

Call to ask about Debt Management Program vs. Orderly Payment of Debts in Alberta

Both programs offer debt relief, but the Orderly Payment of Debts (OPD) stands out from the Debt Management Program (DMP) because of its government support, low interest rate, and legal protections. If you live in Alberta and feel stuck with debt, Money Mentors is here to help.

Ready to take control of your money? Contact Money Mentors today for a free consultation and get advice on your best debt repayment option.