Why the OPD Program Alberta Could Be Your Best Debt Solution

Debt can feel like quicksand — no matter how hard you try to climb out, you just keep sinking deeper. Each payment you make feels like grabbing at branches that snap under pressure, leaving you stuck right where you started. But there’s a strong, steady hand reaching into that quicksand, ready to pull you out: the Orderly Payment of Debts (OPD) program in Alberta, administered exclusively by Money Mentors.

The OPD program isn’t like other debt solutions; it’s a one-of-a-kind, government-approved, legally protected lifeline. A clear, structured path to debt freedom, with lower interest rates and zero harassment from creditors. Certified Financial Counsellors are ready and standing by to throw you a rope — but more importantly, guide you through a safe, structured way to stop sinking and find your way back to solid financial ground.

For employed Albertans, the OPD Program offers unique advantages: predictability and stability. With a steady income, you’ll find it easier to navigate the program’s structured plan, confidently make progress on your debt, and see real results month after month.

Debt in Alberta is a Shared Challenge

Alberta thrives on resilience and hard work, but even the strongest shoulders can buckle under financial pressure. If you’ve ever stared at a growing stack of bills, wondering how you’ll make ends meet, or felt the crushing weight of tax debt and mounting expenses, know this: You’re far from alone.

- 71% of Albertans worry about meeting both current expenses and future goals.

- Nearly half of Albertans have less than $200 breathing room before missing financial obligations.

It’s a tough reality, but there’s hope. The OPD is a federally legislated debt repayment solution designed to provide relief and a path toward long-term financial stability.

How the OPD Program Alberta Works

The OPD Program in Alberta stands apart from all other debt consolidation options — it’s a game-changing financial reset designed to help Albertans break free from the weight of high-interest debt. Whether you’re buried under past-due credit card bills or are a self-employed Albertan wrestling with years of unpaid taxes to the CRA, the OPD process can help.

A Federally Legislated Debt Repayment Plan

An Orderly Payment of Debts isn’t a temporary fix. It’s a government-backed payment plan that helps people pay off their debts in an easier and more manageable way.

- One easy monthly payment: Instead of trying to pay all of your different bills throughout the month — like credit cards, personal loans, or payday loans — you combine them into a single monthly payment. No more juggling multiple due dates.

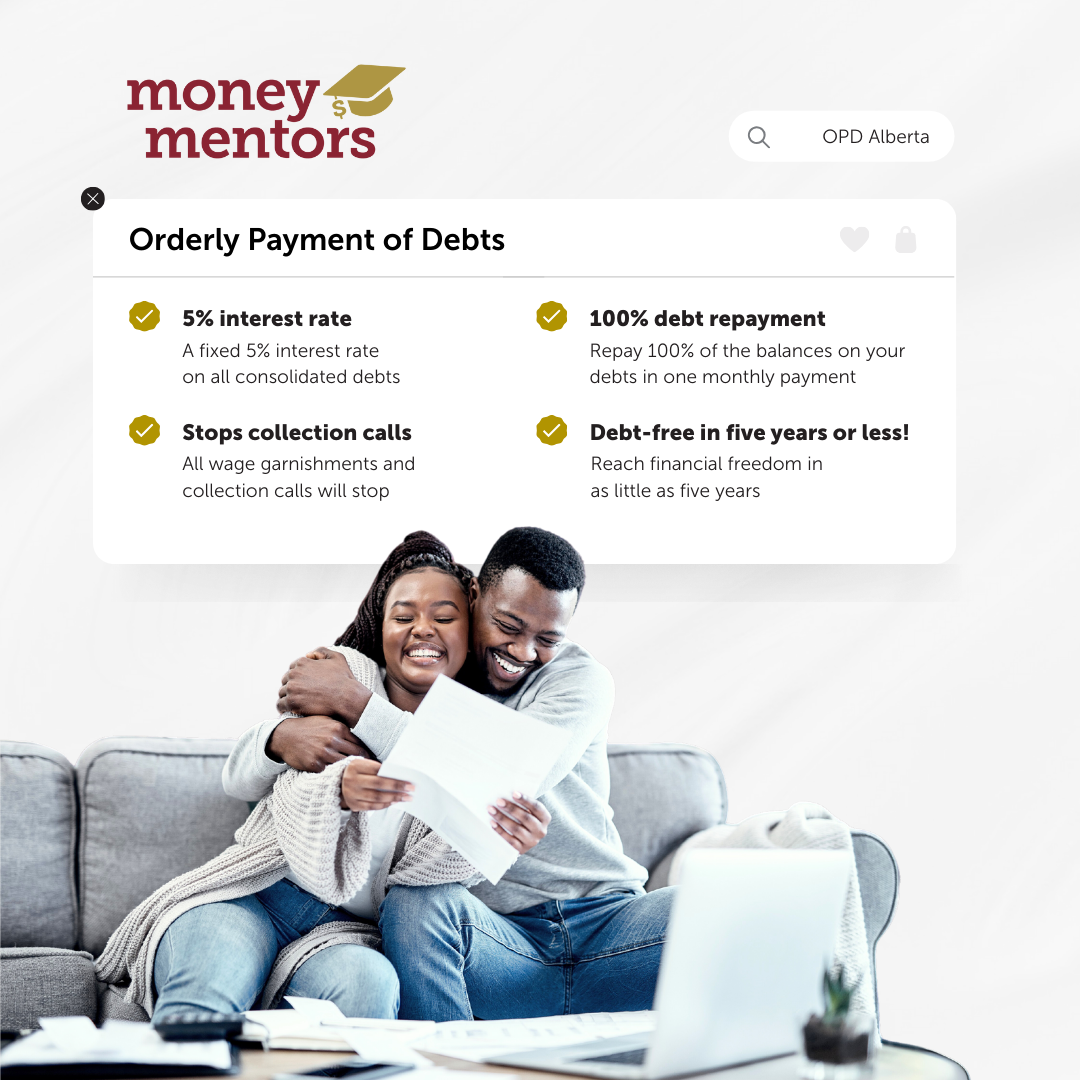

- A fixed 5% interest rate: Rather than dealing with 18% to 29% credit card rates, or even higher payday loan rates, you’ll lock in a fixed 5% interest rate. That means more of your money goes toward actually paying off your debt instead of getting swallowed up by interest charges.

- Legal protection from creditors: One of the best things about the OPD is the legal protection it offers. Creditors (the companies you owe money to) can’t call and harass you for payments anymore. They also can’t garnish your wages (take money directly from your paycheque before you receive your money). Everyone has to follow the rules set by this government-approved debt repayment plan.

- Financial education and budgeting tools: When you have debt, paying it off is only part of the solution. The OPD helps you learn better ways to manage your money so you can avoid falling back into quicksand in the future. Through Money Mentors Alberta, you’ll get access to:

- Budgeting resources to learn how to plan your spending.

- Online courses to build strong financial habits.

- Personalized advice to help you stay on track.

And if that doesn’t bring you the sigh of relief you’ve been looking for, Money Mentors’ credit counsellors are all required to have the Certified Financial Counsellor Canada (AFCC) certification. This means they are trained experts in financial counselling and follow a professional code of ethics and standards. Yep, we’re the real deal.

👉 Learn more about the Orderly Payment of Debts program in Alberta

How the OPD Program Alberta Transformed Kim’s Finances

Four years ago, Kim was $28,000 in debt and felt stuck. “I was overspending, overcommitting, and over it,” she admitted. Struggling to keep up with bills, she turned to the Alberta debt repayment program through Money Mentors for help.

In her first counselling session, Kim’s Certified Financial Counsellor helped her lower her monthly expenses and create a plan. She enrolled in the Orderly Payment of Debts process Alberta offers, and all of her interest rates were lowered to a fixed 5% interest rate and a predictable monthly payment plan.

“Joining the OPD program felt like a weight lifted off my shoulders,” Kim exclaimed. She finally had control over her finances. Living on a cash-only budget was challenging, but she stayed committed. Over time, she repaid her debt in full, built a small emergency fund, and afterward, refocused on her mortgage and retirement savings.

“I’m really proud to have been on the OPD program [because it] kept me accountable for all my debts … There was a plan in place to take care of them.”

Today, Kim feels confident and optimistic about her financial future. Her advice? “Contact Money Mentors immediately. To have someone that has your back… it’s a great feeling. Money Mentors changed my life!”

Why a Stable Income Matters for the Orderly Payment of Debts Program Alberta

If you’re exploring how to apply for Orderly Payment of Debts in Alberta, having a steady income can make all the difference. An OPD can take up to five years to complete, and having a reliable paycheque ensures you can stick with it from start to finish.

- A predictable paycheque means no more worrying about how you’re going to cover your debt payments. You’ll know exactly what you will pay every month and can plan for it.

- Regular income makes it easier to keep up with bills, buy groceries, and even set aside a little savings — helping you breathe easier.

- Over time, a steady income will keep you moving forward. Every single payment you make brings down the principal amount owing in a significant way, moving you closer to being debt-free.

Does that mean that you need to have a full-time salary and a paycheque every second Friday in order to qualify for the Orderly Payment of Debts program from Money Mentors? Not at all. Stable income comes in many forms, and we can get creative with you, but the key is that your income is received at regular intervals and you can depend on it. This can include income from dependable contracts where work and payments are consistent, or averaging out your annual irregular income and living on the same dollar amount each month, regardless of whether you make less or more.

Because the bottom line is that even with regular pay, right now nearly half of Albertans are living paycheque to paycheque, which can make it unbelievably tough when interest rates go up, or unexpected expenses all come at once. That’s where the OPD can really make a difference — it adds that structure and predictability to your finances, even when life feels a bit uncertain.

An OPD isn’t about making your life harder — it’s about giving you a clear plan and support system to tackle your debt step by step. And with a reliable income, you’ll have the tools and stability you need to succeed.

Key Benefits of the Orderly Payment of Debts Program Alberta

Enrolling in the Orderly Payment of Debts Alberta solution does more than just consolidate your debts — it allows you to pay off 100% of your consolidated debt at 5% interest in 5 years or less. (Let’s repeat that a little louder for those in the back):

And the standout perks don’t end there…

- Protected assets: You usually keep essential assets (like your home or vehicle) while participating in the OPD.

- Reduced stress and anxiety: Many participants report a sense of relief knowing creditor calls and legal actions stop.

- Possible credit score rebound: Your credit score will initially dip. However, consistent on-time payments often lead to gradual improvements, and we’ll provide education every step of the way.

- Lower interest costs: Replacing astronomically high interest rates with a fixed 5% interest rate means substantial savings over time. More of your money goes toward the principal instead of the interest.

- Educational support: Money Mentors will provide you with workshops and online resources, ensuring you build lasting financial habits.

MNP reports that 62% of Albertans remain worried about repaying their debts, and 22% feel they may be insolvent right now. Filling out an OPD Alberta application can be the turning point for those seeking more predictable, manageable finances.

Is an OPD Right for You?

Certain life stages and financial circumstances make an Orderly Payment of Debts especially beneficial.

- High-interest debt overload: If you’re barely touching the principal of your debt because steep interest rates are keeping you buried, it can help reduce the burden by lowering interest rates to 5%.

- Pre-retirement planning: Lowering monthly payments before retirement can set you up for greater financial security in your later years.

- Inflation pressures: When daily costs are rising, this government-approved debt repayment plan Alberta residents trust can stabilize your monthly expenses.

However, the OPD program may not be a fit for everyone. If you have secured debt (like a mortgage or car loan), the program won’t cover it. And if your income isn’t enough to take care of your living expenses and OPD payments, we will dig in deeper with you to find out if other solutions may be better. If you’re still on the fence, feel free to call and ask about your unique situation, or you can explore whether the OPD is a good match for you by reading Is OPD Right for You?

Orderly Payment of Debts vs Bankruptcy Alberta

If you’re thinking about the Orderly Payment of Debts vs. Bankruptcy in Alberta, it’s important to weigh out the pros and cons of each option carefully. While bankruptcy can discharge certain debts quickly, it also comes with major consequences, such as damage to your credit and potential loss of assets like your car or home. An Opd allows you to fully pay back your debts at a 5% interest rate while protecting your wages from garnishment and stopping those unfathomably relentless creditor calls while having a more permanent, positive impact on your long-term credit health.

For a deeper comparison, check out Bankruptcy vs OPD.

Take the First Step Toward Debt Relief

The Orderly Payment of Debts (OPD) program in Alberta isn’t a quick-fix solution — it’s a reliable path toward financial well-being. For employed Albertans grappling with rising interest rates, inflation, or multiple high-interest debts, the OPD stands out as a proven solution.

- Learn how to apply for the Orderly Payment of Debts in Alberta

- Discover more of the benefits of the OPD program

- Call us to ask any questions you may have

If you’re ready to end the stress and move toward a debt-free life, Money Mentors Alberta is here to guide you. Book your free OPD credit counselling appointment today and start your journey toward a more financially stable future.

Additional Resources for Albertans Seeking Debt Relief

Have questions?

Need more information or want to talk to a certified financial counsellor for peace of mind? Let us help.

Call 1-888-294-0076 or book an appointment. It’s free for all Albertans.