For Nearly Half of Albertans, Financial Survival Is a Daily Fight

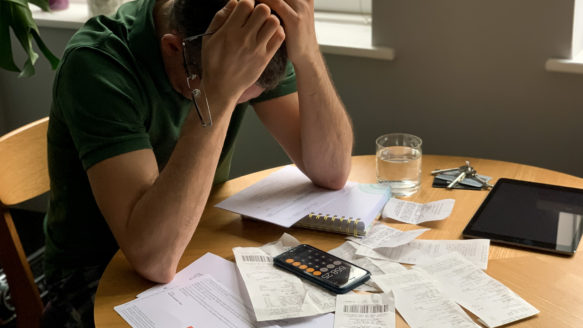

Let’s not sugarcoat it — Alberta is facing a full-blown debt crisis. The latest MNP Consumer Debt Index reveals that 43% of Albertans are just $200 away from financial insolvency each month. Let that sink in: Nearly half of Alberta is one car repair, root canal, or furnace breakdown away from financial disaster.

“We’re seeing a significant rise in financial anxiety,” said Stacy Yanchuk-Oleksy, CEO of Money Mentors, the Alberta-based, non-profit credit counselling agency. “Many Albertans are living on the edge, with little to no wiggle room in their budgets to deal with emergencies.” If you’re reading this and thinking, That sounds like me, you’re not alone — and we’re here to help.

Confidence in Handling Debt is Crashing

Your finances aren’t just about the bank account balances — it’s about the gut-wrenching uncertainty that keeps you tossing and turning at night. Canadians are feeling less and less certain about how to manage their money and debt in 2025. In fact, their confidence levels just plummeted to the lowest level ever recorded by the MNP Debt Index. And believe it or not (we’re sure you do), Albertans are feeling it even harder than the rest of the nation, with four in ten Albertans worried about job losses or household employment instability.

We get it. When the cost of living keeps climbing, and your income doesn’t, it can feel like the ground is crumbling beneath you.

When Ends Don’t Meet

The numbers paint a bleak picture. Half of Canadians say they’re struggling to pay their bills and debts, and 35% admit they can’t cover them at all. In Alberta, 28% of residents say they’re insolvent or just barely scraping by each month.

Every dollar counts — but it seems there’s never enough of them to go around.

Money Mentors’ certified financial counsellors hear it all the time: ‘I feel like I’m drowning. No matter how hard I work, I just can’t seem to get ahead.’

Sound familiar? You’re not alone in this, and there are ways out.

Shame, Fear, and Distrust Are Keeping Albertans Stuck

Reaching out for help when you’re buried under credit card bills, lines of credit, payday loans, or demands to pay your taxes can feel extremely overwhelming, and it’s no surprise why… More than half of Canadians (53%) say they have trouble trusting debt professionals, and 48% feel too embarrassed to ask for any kind of support. The fear of being judged — or worse, scammed — keeps so many Albertans stuck in silence.

Here’s the thing, though. Sitting in shame won’t pay the bills, and it definitely doesn’t fix the debt problem. You deserve help that’s kind, trustworthy, and actually effective. That’s where Money Mentors comes in.

We’re a non-profit, government-backed organization here to help Albertans dig out of debt without the judgment. Seriously, we’ve got your back.

The Real Cost of Financial Stress

Debt isn’t just about money. It’s about the screaming and fighting it causes between your four walls, constant panic, and the heavy toll it takes on your mental health. And when unexpected expenses hit — like a vet bill or a forgotten annual subscription being pulled from your bank account — many Albertans feel forced to take drastic measures.

People are selling belongings, taking on payday loans, or borrowing from family just to make it to the next month. But those short-term fixes often lead to even deeper financial struggles.

A Better Way Forward

If you’re feeling stuck in a never-ending cycle of debt, there’s good news: you don’t have to navigate this alone. Programs like Money Mentors’ Orderly Payment of Debts (OPD) in Alberta offer a safe, proven way to get out of debt — without the fear of scams or judgment.

With 25 years of supporting Albertans with managing their debt, Money Mentors’ OPD is a government-approved debt repayment program that consolidates your debts into one affordable monthly payment with a reduced interest rate (5% max). No shady gimmicks, no hidden fees. Just a clear path to financial stability.

It’s Time to Take the First Step

Reaching out for help is the first step, and it’s easier than you might think. At Money Mentors, we offer confidential, immediate support tailored to your situation. Our goal is to help you take control of your money and be able to breathe easier.

We’re not just about numbers; we’re about people. People like you who deserve a fresh start and a chance to breathe again. Call Money Mentors at 1-888-294-0076 to get started.

If you’re in Alberta and feeling the crushing weight of debt, we’re here for you. Let’s take a look and tackle this together.

Have questions?

Need more information or want to talk to a certified financial counsellor for peace of mind? Let us help.

Call 1-888-294-0076 or book an appointment. It’s free for all Albertans.