RRSP or TFSA: Which Do Canadian Families Prefer?

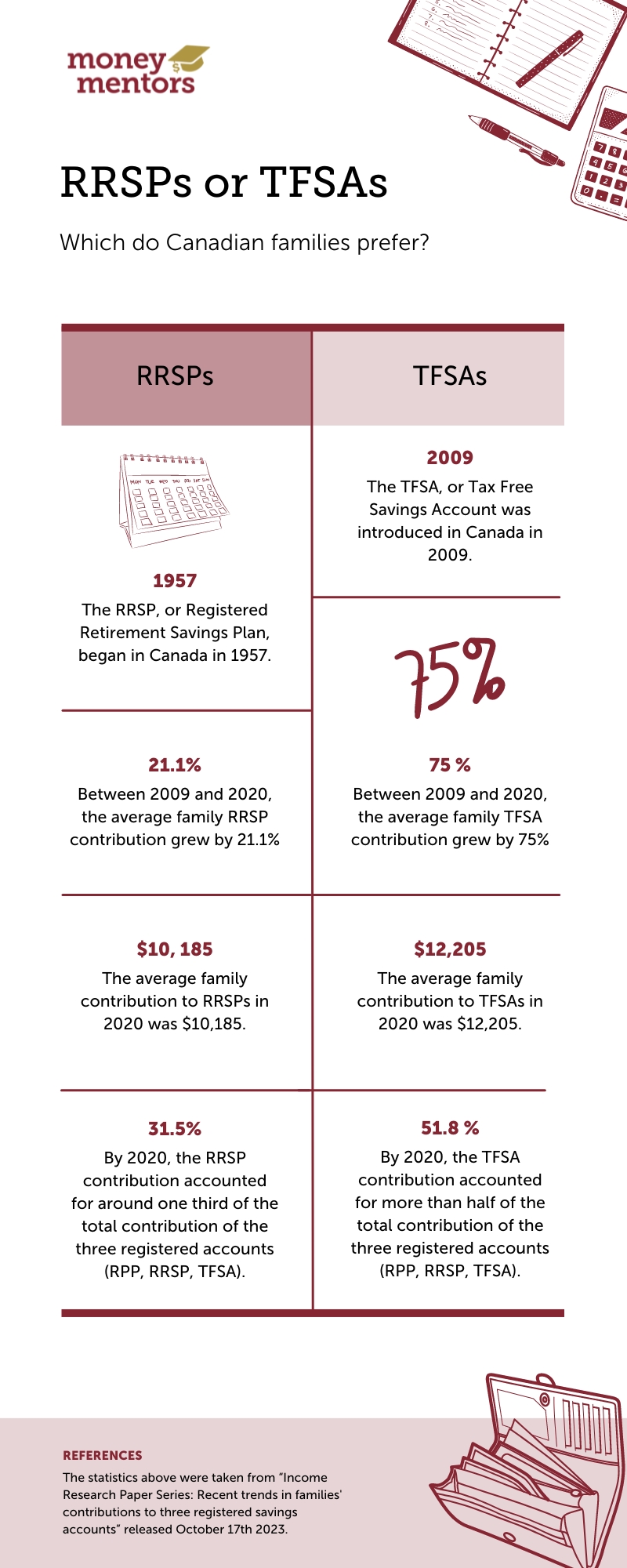

Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs) have become integral parts of Canadian financial planning. Introduced in 1957 and 2009 respectively, these savings vehicles serve distinct purposes. RRSPs primarily focus on retirement savings with tax-deferred growth, while TFSAs offer a flexible saving option with tax-free earnings and withdrawals.

Statistics Canada Report

Looking at the October 17th, 2023 report from Statistics Canada, let’s explore the recent trends in families’ contributions to registered savings accounts.

Trends in Contributions

Since the introduction of TFSAs in 2009, there has been a notable shift in the savings behavior of Canadian families. Between 2009 and 2020, the average contribution to registered accounts (RPP, RRSP, or TFSA) grew by 54.4%, highlighting an increasing focus on savings. Notably, TFSA contributions increased by 75% during this period, significantly outpacing the growth in RRSP contributions, which saw a 21.1% increase.

Average Contributions Comparison

In 2020, the average family contribution to TFSAs exceeded that of RRSPs. This shift can be attributed to the flexibility and tax advantages offered by TFSAs, appealing to a broader range of savers.

Shifting Contribution Shares

The contribution shares of RRSPs and TFSAs within the total contributions to registered accounts have evolved. In 2009, TFSAs accounted for 28.2% of total contributions, but by 2020, this figure had risen to 51.8%. In contrast, RRSP contributions, which represented 49.2% of total contributions in 2009, decreased to 31.5% by 2020.

Should I Put Money in an RRSP or TFSA?

RRSPs offer the benefit of tax-deductible contributions, making them a powerful tool for long-term retirement savings, especially for those in higher tax brackets. However, withdrawals are taxable.

On the other hand, TFSAs, with their tax-free growth and withdrawals, provide more flexibility. They are ideal for short to medium-term savings goals and for individuals who anticipate being in a higher tax bracket in the future.

The choice between RRSPs and TFSAs isn’t one-size-fits-all. It’s influenced by factors such as your current and expected future income, retirement plans, and immediate financial needs. Given the complexity of these decisions and the unique nature of everyone’s financial situation, the best course of action is to seek personalized advice.

To thoroughly explore your options and make an informed decision tailored to your circumstances, consider booking a free consultation with a Money Mentors counsellor who can provide invaluable guidance in navigating these choices and planning a secure financial future.

For more detailed comparisons and insights, visit Money Mentors’ guide on RRSPs vs. TFSAs: RRSP vs. TFSA: What’s Best for You?

Have questions?

Need more information or want to talk to an accredited financial counsellor for peace of mind? Let us help.

Call 1-888-294-0076 or book an appointment. It’s free for all Albertans.